- What is CRM in Banking Industry?

- How CRM in Banking Sector is Transforming the Customer Journey

- Top 10 Ways CRMs Are Improving Bank Lending

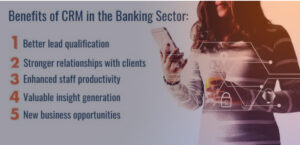

- Advantages of CRM in Banking Sector

CRM has the power to transform the banking sector's customer journey, providing seamless experiences and driving digital innovation. This elevates the industry to new heights, improving the overall customer experience.

The banking and financial services industry has undergone a significant shift in recent years, with the adoption of Customer Relationship Management (CRM) solutions becoming increasingly prevalent. The need for more efficient ways to track customer interactions and data has become paramount as these institutions strive to digitize their operations.

CRM for banks allows bankers and financial professionals, such as representatives and advisors, to manage customer information more efficiently, thereby enhancing the overall customer experience. Its continued adoption is at the forefront of driving digital transformation in the industry. In this article, we will delve into the importance of CRM in banking sector and examine how they drive digital transformation.

What is CRM in Banking Industry?

The banking industry is facing mounting pressure from various fronts, including increased competition, growing customer demands, and employees seeking a better workplace. By 2025, as much as 40% of banks’ collective revenue could be at risk from new digital competition.

To keep pace with these changes, banks have to manage a customer base that is both increasingly digital and diverse. Staying current with the latest technologies is no longer sufficient; banks must anticipate the needs of a rapidly evolving customer base. A study shows that one in three millennials in the United States is open to switching banks within the next 90 days, and a similar proportion believes they may not even need a bank in the future.

To keep pace with these changes, banks have to manage a customer base that is both increasingly digital and diverse. Staying current with the latest technologies is no longer sufficient; banks must anticipate the needs of a rapidly evolving customer base. A study shows that one in three millennials in the United States is open to switching banks within the next 90 days, and a similar proportion believes they may not even need a bank in the future.

This highlights the importance of CRM in banking sector. A CRM for banks can bridge the gap between customers and banks, enabling financial representatives to better understand their customer profiles, offer targeted services, and resolve any issues they may have. In short, a CRM can help banks build stronger relationships with customers, ultimately driving growth for the business.

While traditionally, banks rely on paper records and manual processes to manage customer data, a CRM for banks can streamline these processes and take the business to the next level.

Let’s discuss the importance of CRM in banking sector in two key areas where it has a significant impact on the customer journey and lending.

How CRM in Banking Sector is Transforming the Customer Journey

In today’s digital age, customers are increasingly expecting a personalized, convenient, and hassle-free experience. They also want their interactions with their bank to be consistent across all channels which reflects the importance of CRM in banking sector. To meet these expectations, banks must rethink their customer journey and explore how CRMs can help to create a more seamless experience.

A CRM is designed to help businesses manage their interactions with customers by collecting data from various channels and consolidating it into a single platform. By giving banks a 360-degree view of their customers, CRMs allow banks to understand their needs and expectations better and create a more personalized experience.

In the past, most banks did not realize the importance of CRM in banking sector and used separate systems for managing customer data. CRMs break down these silos by consolidating customer data into a single platform, giving banks a complete picture of the customer journey and allowing them to identify pain points and areas for improvement.

CRMs also enable banks to automate repetitive tasks, such as sending out account statements. This frees staff to focus on more complex tasks. Providing a more personalized and seamless customer experience with a CRM is essential in today’s competitive market.

Another reason why the importance of CRM in banking sector has witnessed huge rise is because banks now also leverage a CRM in the lending department due to all the analytical data and forecasts the system can provide to help with risk assessment.

Top 10 Ways CRMs Are Improving Bank Lending

CRMs are revolutionizing the way lending practices are conducted. By leveraging the power of customer relationship management, banks are able to gain a deeper understanding of their customers and their needs, resulting in more informed lending decisions and improved loan terms for borrowers. The following are the ways in which CRM for banks is changing the lending industry:

1. Speed and Convenience: Take advantage of CRM technology to improve your bank’s lending operations. It provides a comprehensive view of borrowers’ financial history, and credit score. Automating data collection and analysis reduces evaluation time, improving efficiency and customer service. CRM technology transforms the lending industry by providing informed decision-making tools, streamlined operations, and enhanced customer experience. Stay caught up – embrace CRM technology today!

1. Speed and Convenience: Take advantage of CRM technology to improve your bank’s lending operations. It provides a comprehensive view of borrowers’ financial history, and credit score. Automating data collection and analysis reduces evaluation time, improving efficiency and customer service. CRM technology transforms the lending industry by providing informed decision-making tools, streamlined operations, and enhanced customer experience. Stay caught up – embrace CRM technology today!

2. Personalized Service: Banks that utilize CRM have a powerful tool in their hands to effectively categorize customers and offer tailor-made services that cater to their unique requirements. This results in a highly personalized customer experience, leading to elevated levels of customer satisfaction and loyalty. Don’t miss out on the opportunity to enhance your customer experience – adopt CRM today.

2. Personalized Service: Banks that utilize CRM have a powerful tool in their hands to effectively categorize customers and offer tailor-made services that cater to their unique requirements. This results in a highly personalized customer experience, leading to elevated levels of customer satisfaction and loyalty. Don’t miss out on the opportunity to enhance your customer experience – adopt CRM today.

3. Better Loan Terms: Banks can significantly benefit by gaining a deeper understanding of their customers. By doing so, they can offer loan terms that are more competitive, resulting in lower interest rates and better repayment plans for borrowers. This approach not only helps banks to attract more customers, but also ensures that they retain existing ones by providing them with a satisfying borrowing experience.

3. Better Loan Terms: Banks can significantly benefit by gaining a deeper understanding of their customers. By doing so, they can offer loan terms that are more competitive, resulting in lower interest rates and better repayment plans for borrowers. This approach not only helps banks to attract more customers, but also ensures that they retain existing ones by providing them with a satisfying borrowing experience.

4. Increased Transparency: Customer Relationship Management (CRM) is a powerful tool that enables banks to provide their customers with a transparent loan process. By utilizing pre-built indicators and statistical reports, banks can offer real-time work results to borrowers. This level of transparency instills trust and confidence between the bank and the borrower, ultimately leading to better customer satisfaction and a smoother loan process.

4. Increased Transparency: Customer Relationship Management (CRM) is a powerful tool that enables banks to provide their customers with a transparent loan process. By utilizing pre-built indicators and statistical reports, banks can offer real-time work results to borrowers. This level of transparency instills trust and confidence between the bank and the borrower, ultimately leading to better customer satisfaction and a smoother loan process.

5. Improved Customer Retention: CRM has become crucial for banks to enhance their lending experience and improve customer retention. By leveraging CRM, banks can analyze customer data to identify trends, make informed business decisions, and develop targeted marketing campaigns, increasing engagement and loyalty. CRM has become a game-changer for the banking sector, providing banks with the necessary tools to keep their customers happy.

5. Improved Customer Retention: CRM has become crucial for banks to enhance their lending experience and improve customer retention. By leveraging CRM, banks can analyze customer data to identify trends, make informed business decisions, and develop targeted marketing campaigns, increasing engagement and loyalty. CRM has become a game-changer for the banking sector, providing banks with the necessary tools to keep their customers happy.

6. Reduced Risk: In banking, using Customer Relationship Management (CRM) tools allows for a more comprehensive evaluation of a borrower’s creditworthiness and repayment capacity. Banks can make informed decisions and provide tailored financial solutions to their customers by leveraging the data collected through CRM systems. This ultimately leads to a more efficient and effective lending process, benefiting both the lender and the borrower.

6. Reduced Risk: In banking, using Customer Relationship Management (CRM) tools allows for a more comprehensive evaluation of a borrower’s creditworthiness and repayment capacity. Banks can make informed decisions and provide tailored financial solutions to their customers by leveraging the data collected through CRM systems. This ultimately leads to a more efficient and effective lending process, benefiting both the lender and the borrower.

7. Increased Efficiency: Banks can significantly improve their overall efficiency and performance by implementing automation for certain aspects of their lending process. This automation helps them save time and resources, resulting in increased profitability. It allows banks to streamline their lending operations and reduce the potential for errors or delays while providing a more seamless and convenient experience for their customers.

7. Increased Efficiency: Banks can significantly improve their overall efficiency and performance by implementing automation for certain aspects of their lending process. This automation helps them save time and resources, resulting in increased profitability. It allows banks to streamline their lending operations and reduce the potential for errors or delays while providing a more seamless and convenient experience for their customers.

8. Improved Compliance: By utilizing this technology, banks can enhance their ability to comply with regulations governing the loan process. This results in better risk management, increased operational efficiency, and reduced compliance-related costs. The solution empowers banks to maintain compliance with regulatory requirements and stay ahead in an ever-changing regulatory environment.

8. Improved Compliance: By utilizing this technology, banks can enhance their ability to comply with regulations governing the loan process. This results in better risk management, increased operational efficiency, and reduced compliance-related costs. The solution empowers banks to maintain compliance with regulatory requirements and stay ahead in an ever-changing regulatory environment.

9. Greater Insight: Customer Relationship Management (CRM) is a powerful tool that helps banks better understand their customers’ behavior and preferences. Banks can identify patterns and trends that would otherwise go unnoticed by analyzing the data collected from various sources, such as social media activity, transaction history, and feedback surveys. By leveraging this valuable information, banks can make better-informed lending decisions that meet their customers’ needs and expectations.

9. Greater Insight: Customer Relationship Management (CRM) is a powerful tool that helps banks better understand their customers’ behavior and preferences. Banks can identify patterns and trends that would otherwise go unnoticed by analyzing the data collected from various sources, such as social media activity, transaction history, and feedback surveys. By leveraging this valuable information, banks can make better-informed lending decisions that meet their customers’ needs and expectations.

10. A better bottom line: Banks can improve their lending process using CRM software by streamlining and automating various tasks such as loan application processing and approval. Additionally, a CRM allows banks to make more informed decisions by providing valuable insights into customer behavior. This enables banks to create personalized loan offerings. Ultimately, these efforts increase profitability, making it a win-win situation for banks and customers.

10. A better bottom line: Banks can improve their lending process using CRM software by streamlining and automating various tasks such as loan application processing and approval. Additionally, a CRM allows banks to make more informed decisions by providing valuable insights into customer behavior. This enables banks to create personalized loan offerings. Ultimately, these efforts increase profitability, making it a win-win situation for banks and customers.

advantages of crm in banking sector

The banking industry thrives on effective data collection and utilization.

The banking industry thrives on effective data collection and utilization.

With the aid of Customer Relationship Management (CRM) systems, financial institutions can optimize their lending processes and enhance customer experiences.

Although there may be some reluctance towards implementation, industry leaders recognize the importance of staying current with technological advancements to remain competitive.

By adopting a CRM system, financial institutions can unlock many benefits that will help them reach new heights.